Most people uninvolved or newly involved in the world of cryptocurrency are unaware of the prickly connotations, histories, and etymology of many different memes and phrases. Below is a short explanation of a few of them.

For instance, as it relates to coins, the term “maximalist” or “maximalism” first appeared in 2014. In March 2014, Daniel Krawisz, a co-founder of the Nakamoto Institute (who was later purged for supporting BSV), wrote “The Coming Demise of the Altcoins (And What You Can Do to Hasten It).” It never said the word maximalism but used many of the same arguments and logic that maximalists would later adopt. In November of that year, Vitalik Buterin wrote perhaps the first article explaining its origin and then-usage. Subsequently, there are about a million twitter threads (in English alone) that use it in some form or fashion.

In general, its original usage was similar to how “maximalism” is used in politics, economics, sports, and other areas of human competition, with connotation similar to dominance or hegemony.

What did Bitcoin maximalism – or any coin maximalism – mean? In short, it meant that Bitcoin (or some specific coin) – for a variety of reasons – was the Highlander coin, the one coin to rule them all. And that the rest were pretenders to the throne, predestined to fail or at a minimum be a far distant number two. Uni-coin maximalism.

This all sounds silly and cultish and it truly is. Especially the “predestined” element.

Why? Because cryptocurrencies fundamentally rely on blockchains, and blockchains are run by machines that are maintained by humans. Hence the term: Soylent Blockchains. Blockchains come and go, there are hundreds of dead coins that failed for one reason or the other. Thus empirically we know that claiming a priori, one specific chain will dominate (or fail), is both fallacious and a fools errand. There is nothing mystical or supernatural about cyber coins and their underlying infrastructure. That is not to say that all chains are going to fail or that all chains have the potential to become widely used. There is a lot of middle ground in the spectrum between all dead and a popular meme coin.

But back to the topic at hand: coin tribes. Note: it bears mentioning that “tribe” itself is a centuries old term, the etymology dating back to medieval France and Roman times.

By mid-2017, mania surrounding initial coin offerings (ICOs) throttled up, resulting in not just large public capital raises, but also unadulterated tribalism. Us versus them attitudes reached fever pitch in late 2017 with dozens of coins hitting all-time highs in market value. Bitcoin peaked at just under $20,000 on December 17th.

During this time, promoters and advocates of uni-coin maximalism started exploring new ways to segment other tribes. Often this involved smearing one or more coins, loudly, repeatedly calling someone or some project fraudulent or scams. Paying for twitter bots to brigade threads with nonsense or defamatory claims or both. FUD, inglorious FUD.

Arguably the worst offender was the attempt to segment specific clusters of people who held similar views into arbitrary categories that were at a minimum, demeaning pejoratives.

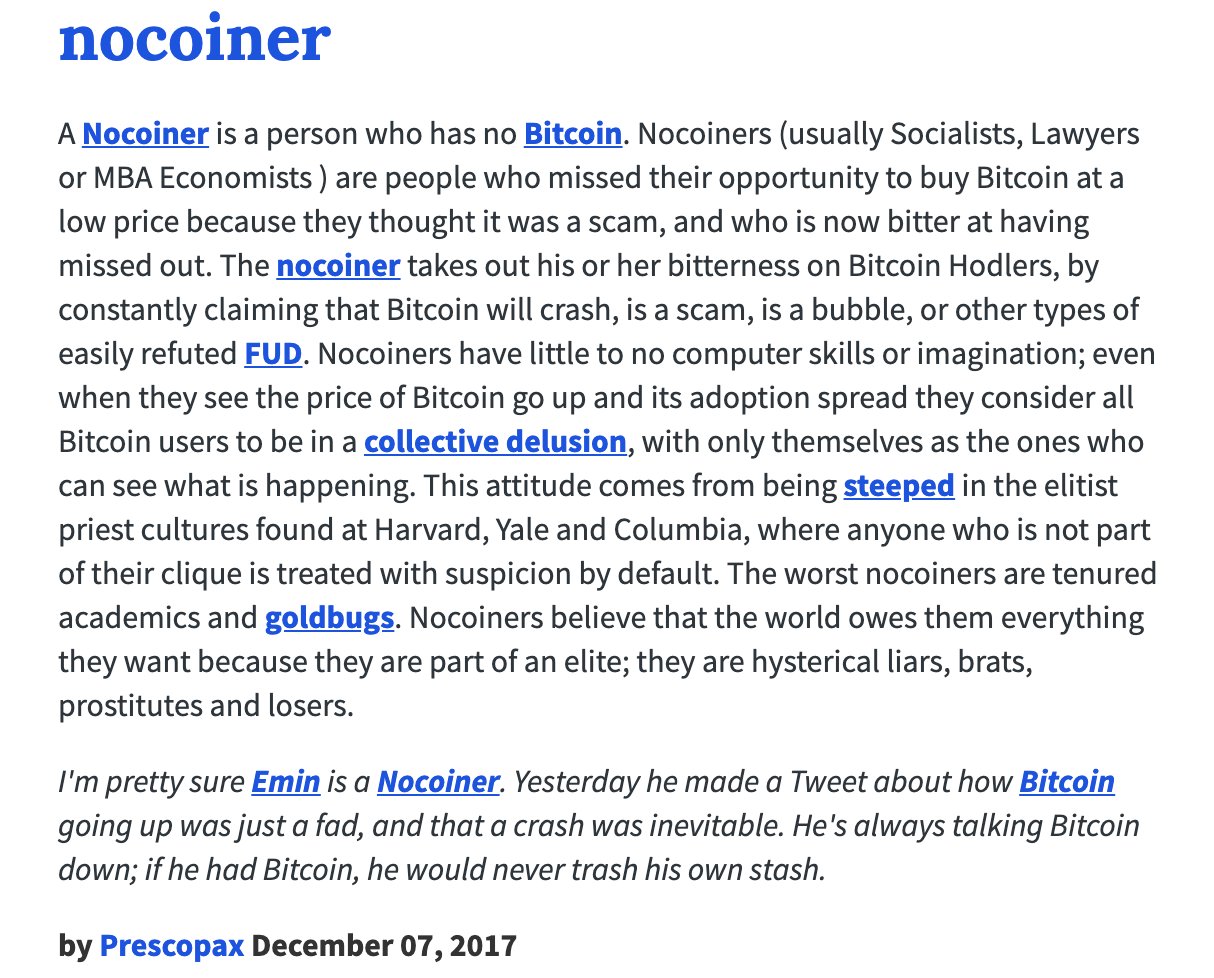

For instance, below is the original definition of “nocoiner”:

It is baffling that anyone would write this but we (probably) know who co-created it: Pierre Rochard and Elaine Ou, both prominent Bitcoin maximalists. Rochard is the co-founder of the Nakamoto Institute (now at Kraken) and Ou was the co-founder of Sand Hill Exchange, which was sued and shut down by the SEC.

In reading this definition it is unclear why anyone would actively want to self-identify as a “nocoiner.” Yet, it is clear by how the original authors and their close circle of friends used it: not as a term of endearment. 1 On panels, podcasts, news articles: the overtones were understood and explicitly baked into demeaning attacks up through the present day.

Care to engage and object to this definition and its intent? Ou states in her “Reject Nocoiner Orthodoxy” to “never engage a nocoiner.” Michael Goldstein, the other remaining co-founder of the Nakamoto Institute goes into further detail about the various categories (pre-coiner, nocoiner, bitcoiner, etc.) in a 2019 podcast. What is a pre-coiner? Someone who has not yet bought a coin (specifically bitcoin) but who is not a “hysterical loser” nocoiner. Rochard’s numerous interviews leave nothing to the imagination about what the intended connotation we are supposed to conjure up with these categories. Together they laid the foundation for other maximalists not just in the US — see this talk from last year — but also abroad.

Fun fact: the very first time I was called a dirty, filthy “nocoiner” was by a venture capitalist on WeChat, and it came in floods on Twitter immediately thereafter. December 2017 is an amazingly cherished month in this household!

Obviously people are free to identify how they see fit. However, it is worth reconsidering adopting terms with connotations that at the very least were originally crafted to be a hateful pejorative, a slur. And handwaving away its origins, perhaps because you have adopted it as your own identity, does not memoryhole its ill intent.

I used to write a newsletter that chronicled this behavior, perhaps at some point I will get a chance to post some of the doozies.

Is that all the major maximalists?

Oddly enough, although they often fashion themselves as “nocoiners,” a group of anti-coiners exists. Unlike the pejorative nocoiner, anti-coin maximalism can be described thusly: utilizing deduction alone, anti-coin maximalists are individuals who are against the existence of cryptocurrencies (or tokens) without any exception. Follow this group on social media and you will see many of the same set of manners and memes that coin maximalists often deploy.

Are anti-coin maximalists inherently right or wrong? Hitchens’ Razor states: “What can be asserted without evidence can also be dismissed without evidence.”

This cuts both ways: for coin promoters who claim that coin X is the best and the rest are rubbish – without providing evidence – this is just polemical and can be discarded. Similarly, a priori dismissing all crypto projects as scams – without providing evidence of each project – can be dismissed. The burden of proof is clear: the onus is on the party making a positive claim, that is how prosecutors must operate in court.

Why are not all cryptocurrency / tokenization / blockchain projects a scam?

As mentioned in Section 5 in the previous post:

This is a non sequitur though because law enforcement, regulators, and courts in multiple different jurisdictions repeatedly state that the burden of proof rests with the prosecution and must involve “facts and circumstances.”

Philosophically it is also a fallacy of composition. Enterprises big and small often use public key cryptography, append-only databases, and synchronizing distributed systems for day-to-day operations. These are the key pieces of a blockchain, so which part is fraudulent or a scam exactly? Is all tokenization a scam? Is PBFT a scam? Is Onyx a scam? Is Allianz’s project a scam? Is geth a scam? Is Tendermint a scam? Maybe they all are, but the onus rests on those making the positive claim, in this case: the anti-coiners. Continually throwing the baby with the bath water seems like an intellectually dishonest raison d’être.

The attempts at disparage tokenization includes lazily lumping all blockchains — whether they are permissioned or permissionless, or use Proof-of-Work or Proof-of-Stake — altogether as an amorphous blob. One example of rhetoric-filled declarations is that all blockchain usage will lead to the melting of glaciers. Actually it is proof-of-work chains that could eventually lead to this negative externality and unfair (and dishonest) to lump alternative Sybil resistant mechanisms in with the PoW albatross.

But it is too hard to filter through the noise to find a (semi) legitimate protocol!

Yea, it can be unforgiving work. But that is the only intellectually honest way to go about providing analysis or drawing conclusions. Contrary to the memes, harassing blockchain developers or researchers on the bird app is not a perfect substitute for writing a facts-and-circumstances-based case. It is probably not a coincidence that several of the loudest anti-coin voices today seem to have no idea what the history or lineage of tokenization is (hint: it didn’t start with Cryptokitties). Ignorance is a badge of honor!

Disagree? Still hate any and all coins? That is fine but simply disliking tokenization or blockchains because everyone you have encountered turned out to be a scam, does not automatically make all of them scams. If you think you have a good case for why each one undoubtedly is, write it up, and submit it to a three or four letter agency. I am sure they would love to have the ultimate case against all coins to use as a trump card for their next case.

Or as the old law adage goes: if you have the facts on your side, pound the facts; if you have the law on your side, pound the law; if you have neither the facts nor the law, pound the table.

Still disagree? HFSP! Kidding, kidding. It would take pages to write but worth subscribing to LedgerInsights who cover all of the enterprises and institutions attempting to incorporate blockchains and tokenization into their trade lifecycles. The DTCC are clearly scammers!

What is the main takeaway Tim?

Just like sportsball or e-gaming, it is really easy to get caught up in tribes, in us versus them mentality. And for a slew of reasons, social media amplifies the emotions and strong views that seem tightly wed to the coin world. It is not super fun but it is possible to be tribeless, to take a nuanced approach at filtering projects, protocols, and other digitalization efforts. Maybe try out anti-maximalism maximalism for the next few years! And at the very least, try not to throw the baby out with the bathwater.

- In February 2018, Marc Hochstein wrote “The problem with nocoincers” for CoinDesk. The fact that the most recent crop of “nocoiners” – many of whom joined the fray at the height of the bubble in late 2021 – adopted the word as a brand speaks to their lack of literature review. [↩]